According to Vermont Department of Labor, “for every three open jobs in Vermont, there is one person categorized as ‘unemployed.’” This critical shortage of workers in the state informed the Vermont Chamber’s legislative priorities this session, as the advocacy team fought to attract new workers to the state, equip those on the margins with the skills and training they need to join the workforce, secure relief funding for businesses recovering from the pandemic to save jobs, promote growth in emerging industries, and address barriers to growth in areas such as housing, land development, and taxes.

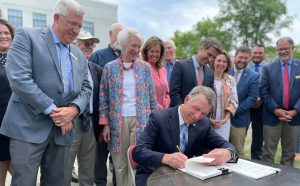

Business Loan-to-Grant Program: S.11, the workforce and economic development bill containing a loan-to-grant business relief program, was signed into law by Governor Scott on June 8. The $19 million business relief program, administered by VEDA, will support businesses whose operations were particularly impacted by pandemic-related economic impacts, such as restaurants, lodging properties, and special events vendors, who were forced to close or severely limit their operations. Businesses that took on significant debt or are still dealing with lingering pandemic impacts should apply for forgivable loans when the program opens applications later this summer.

Growing the Workforce: The Legislature allocated significant resources toward upskilling and training in S.11, signed on June 8, to better equip Vermont workers for in-demand, high-paying jobs, particularly in healthcare and the trades. Funding was also passed for programs geared toward supporting BIPOC business owners as well as justice-involved individuals, and additional funding was passed for retention incentives for New Americans, recent college graduates, and healthcare educators. The Legislature also allocated just over $3 million for the relocation incentive program, which will offset the moving costs for new workers relocating to Vermont. However, there is no funding or critical marketing to tell our story, despite the data showing that many people would move to Vermont without being incentivized because of the quality of life and all Vermont has to offer. This represents a missed opportunity to capture the attention of more workers who may be inclined to make Vermont their permanent home.

Housing: Governor Scott signed S.210 and S.226 into law on June 7. S.226 contains a $15 million investment to develop housing units for the “missing middle income” housing stock. S.210 will focus on rehabilitating dilapidated rental units and building more apartment buildings in downtowns, both of which will increase availability of workforce housing options.

Liquor Law Modernization: 730, containing provisions to modernize Vermont’s liquor laws, was signed into law on June 7. Ready-to-drink (RTD) spirit-based beverages that have a 12% or less ABV will now shift from the exclusive purview of the Department of Liquor and Lottery and will be permitted to be sold in the same retail streams as malt and vinous beverages. First-class licensees will also now be able to serve RTDs, which will provide greater access to products for both licensees and consumers. Additional provisions of interest for the hospitality industry include the ability for third-class licensees to purchase tickets for the rare and unusual product raffle which was previously only available for consumers; and allowing the Department to stagger new and renewal dates for permits versus an annual renewal, which will likely expedite processing times and provide a better permitting process for new businesses.

Healthcare Cost Savings: On May 24, Governor Scott signed into law H.489, a bill which will allow $17.7 million in health insurance cost savings to be extended to small businesses and their workers for another year.

Tax Savings: Governor Scott signed H.510, a tax relief package, into law on May 27. The bill includes a partial military pension tax exemption which excludes the first $10,000 of federally taxable U.S. military retirement pay from taxable income, and subject to adjusted gross income thresholds and phase outs. Governor Scott issued a signing statement, stressing his disappointment that more of his tax relief proposals were not included in the bill. Governor Scott signed S.53, a tax reform bill which includes single sales factor and corporate minimum, into law on May 31. Once fully implemented, analysts with the Legislature’s Joint Fiscal Office said that part of the bill could cut corporate taxes by roughly $11 million a year. Finally, an expanded manufacturing tax exemption in the H.738 Miscellaneous Tax bill was signed into law on June 7. The expansion will exempt machinery and equipment used in integrated production operations and all ancillary processes between raw materials and finished goods, as well as manufacturing for packaging and quality assurance. This change will enhance workforce recruitment and retention, modernize facilities, and make Vermont competitive with the 33 other states that have similar exemptions.

Arts Funding: The $9 million allocated for relief for the creative economy will fund grants to arts nonprofits that suffered from the closures of venues during the COVID pandemic and can be used to bring arts installations into downtowns and other public spaces. This funding was included in S.11, which was signed into law on June 8.

Next session, the advocacy team will continue to build upon these victories, with a renewed focus on securing relocation marketing to grow the workforce and finding solutions to the childcare shortage across the state.