Tax Revenues Strong, But Can We Afford More Spending?

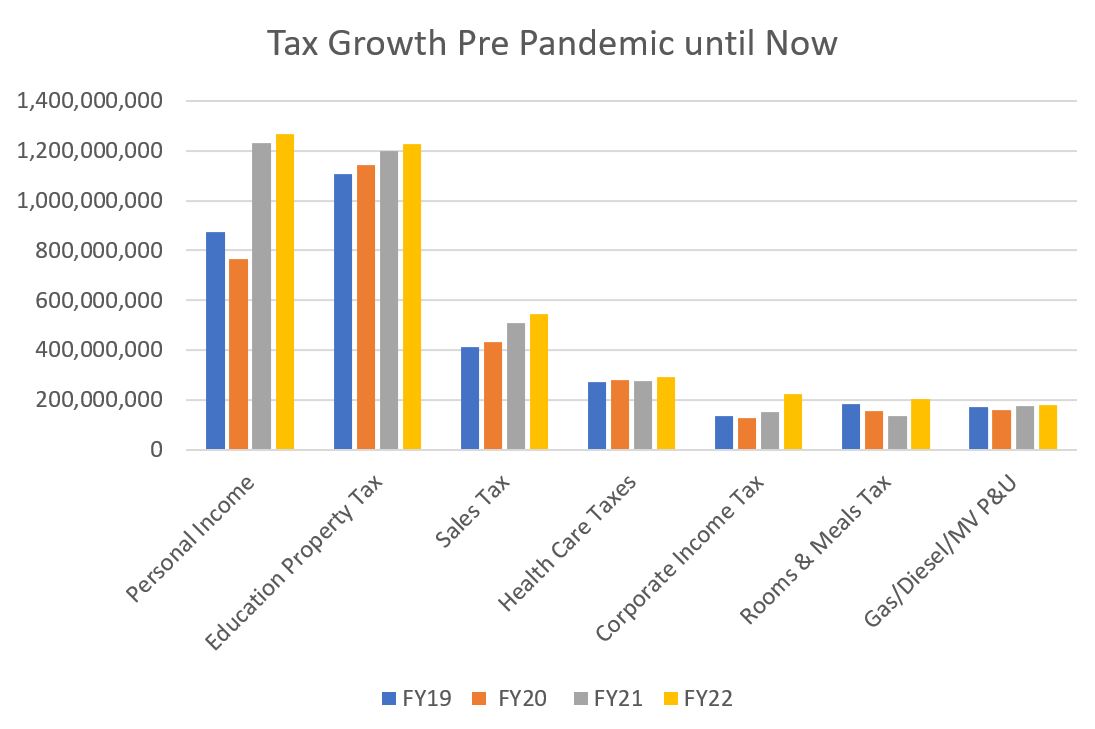

State revenues in the largest tax sources have recovered since FY19, creating a cushion for budget makers. The “Big Three” – personal income tax, property tax and sales taxes are up from three years ago 45%, 11% and 32% respectively. Each month, the Scott Administration messages caution that due to economic uncertainty, we shouldn’t be eager to spend at these new levels and yet, you can read about the call for more spending daily in the news cycle. Housing, childcare, health care, education, and more.

Why It Matters: With economic uncertainty on the horizon due to inflation, decreased consumer spending, and stock market chaos, higher levels of government spending will set a course for higher taxes on individuals and businesses at a time that everything else is on the rise.

Three Concerns, One Big Question:

- Mortgages/rent and food are concerns for individuals while businesses continue to see constrained growth due to a tight labor market, increased wages, inflation, and a disrupted supply chain.

- Over the last two years, the state implemented new programs and higher levels of spending for existing programs supported by one-time federal COVID relief. There will be a huge push to continue this level of spending.

- If Governor Scott loses the ability to sustain a veto, the Democratic majority will need to manage their caucus’ desire to recalibrate state expenditures based on the ability to pay. Shifting childcare, education, and healthcare costs onto the income/payroll tax are all current discussions with price tags in the hundreds of millions.

Question: Can people and businesses really shoulder more taxes right now?