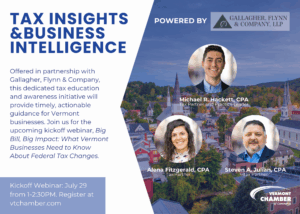

Tax Insights Powered by Gallagher, Flynn & Company

Helping Businesses Navigate Complexity with Confidence

The Vermont Chamber of Commerce and Gallagher, Flynn & Company (GFC), one of the region’s most respected tax and advisory firms, have partnered to launch Tax Insights & Business Intelligence, a dedicated initiative that delivers timely, actionable tax education and guidance for Vermont businesses.

In today’s evolving policy environment, the right tax strategy is not just about compliance. It is a tool for growth and resilience. By combining expert insight with the leadership of Vermont’s statewide business advocacy organization, we are building a resource hub that helps employers plan ahead and remain competitive.

The Tax Insights & Business Intelligence series will expand beyond webinars to include brief video explainers, downloadable issue briefs, and additional programming designed to support informed decision-making. As Vermont’s largest statewide business organization, the Chamber is committed to delivering resources that advance the Vermont economy and support the businesses that make living, working, and thriving in Vermont possible.

Upcoming Webinar

Year-End Planning: What To Do Before the Clock Runs Out

Tuesday, December 9 | Noon

As the year draws to a close, Vermont businesses still have time to make meaningful financial, operational, and tax decisions that strengthen their year-end position and set them up for success in 2026. This session provides clear, actionable guidance to help employers navigate the final weeks of the year with confidence. Attendees will learn how to identify opportunities, anticipate tax obligations, and align year-end actions with long-term goals.

Participants will gain insight into:

- Financial readiness: Ensuring year-end books are accurate and closing processes are on track

- Tax planning and compliance: Identifying opportunities, obligations, and last-minute adjustments

- Strategic and operational review: Assessing performance and identifying priorities for the year ahead

- Communication and coordination: Aligning internal teams and external partners before year-end

- Retirement and personal planning: Understanding individual considerations that influence planning decisions

Previous Webinars

Big Bill, Big Impact

During this 90-minute, insight-packed webinar, the Vermont Chamber and tax experts from Gallagher, Flynn & Company (GFC) unpack what federal tax law changes mean for business financial strategy and long-term planning. Designed for business leaders, CFOs, and key financial decision-makers, the session provides actionable insights to help Vermont businesses make informed decisions and prepare for long-term success in a shifting fiscal landscape. Learn more.