Legislators Continue to Increase Tax Proposals with Only Weeks Left in the Session

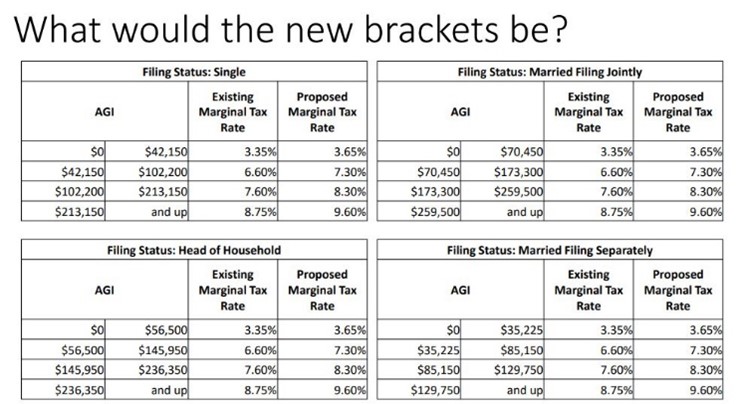

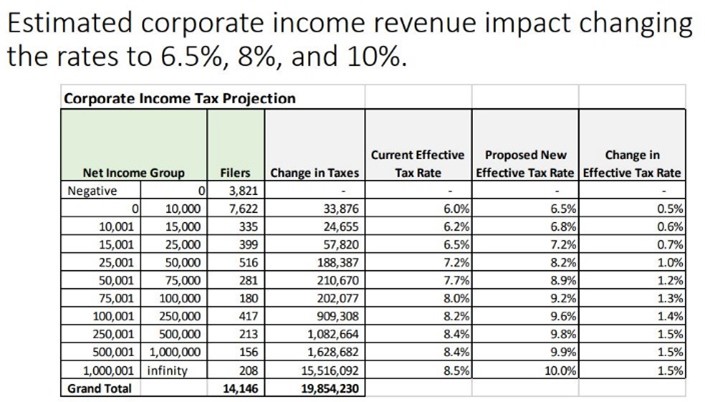

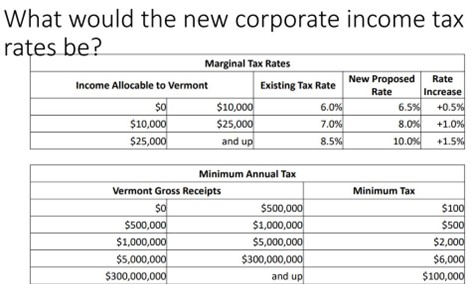

With nearly half a billion in increased costs already on the table, now is not the time for even further tax proposal increases. However, the House Ways and Means Committee continued conversations on a new childcare funding plan that would increase corporate and personal income taxes. Since last week, rate proposals have already increased. New numbers from JFO suggest progressive increases and another rate change in 2028. If passed, S.56 would establish Vermont as having the highest corporate tax in the nation, just one year after the legislature made comprehensive reforms to the corporate tax system, further contributing to an unpredictable business climate.

The committee has yet to hear testimony from anyone outside of legislative employees on the impacts of raising the corporate and personal income tax. The Vermont Chamber is committed to advocating for policies that are rooted in the economic reality of Vermont, and while Vermont is a leader on major initiatives, we cannot afford to do so by placing an undue burden on the people of Vermont.